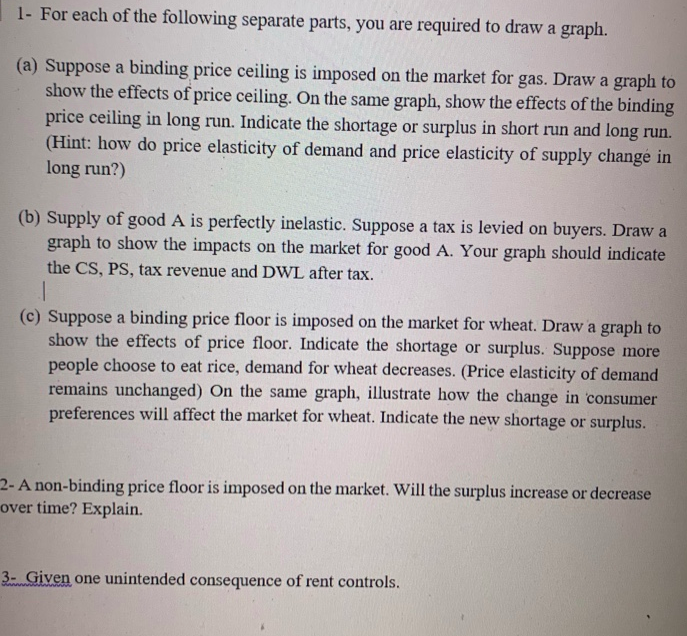

A Binding Price Floor In The Market For Wheat

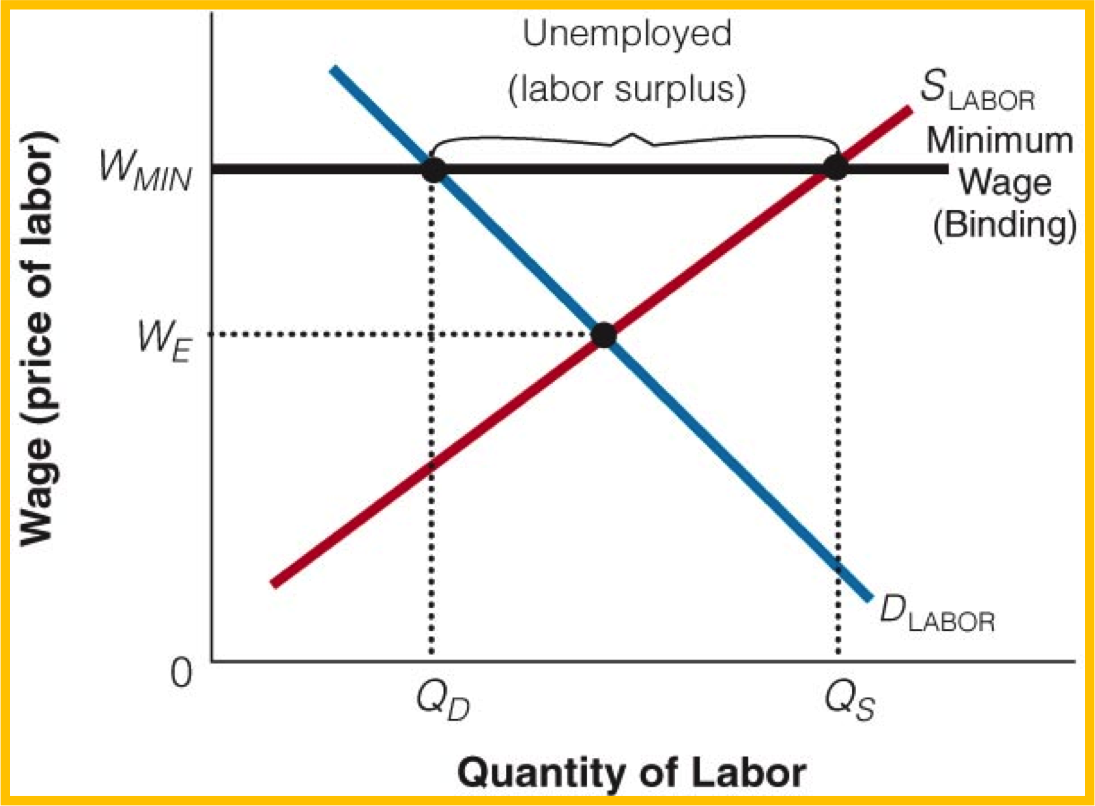

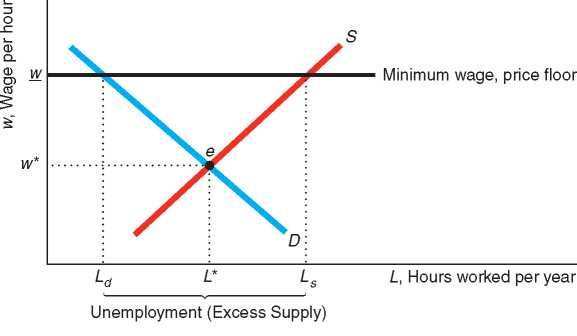

Perhaps the best known example of a price floor is the minimum wage which is based on the view that someone working full time should be able to afford a basic standard of living.

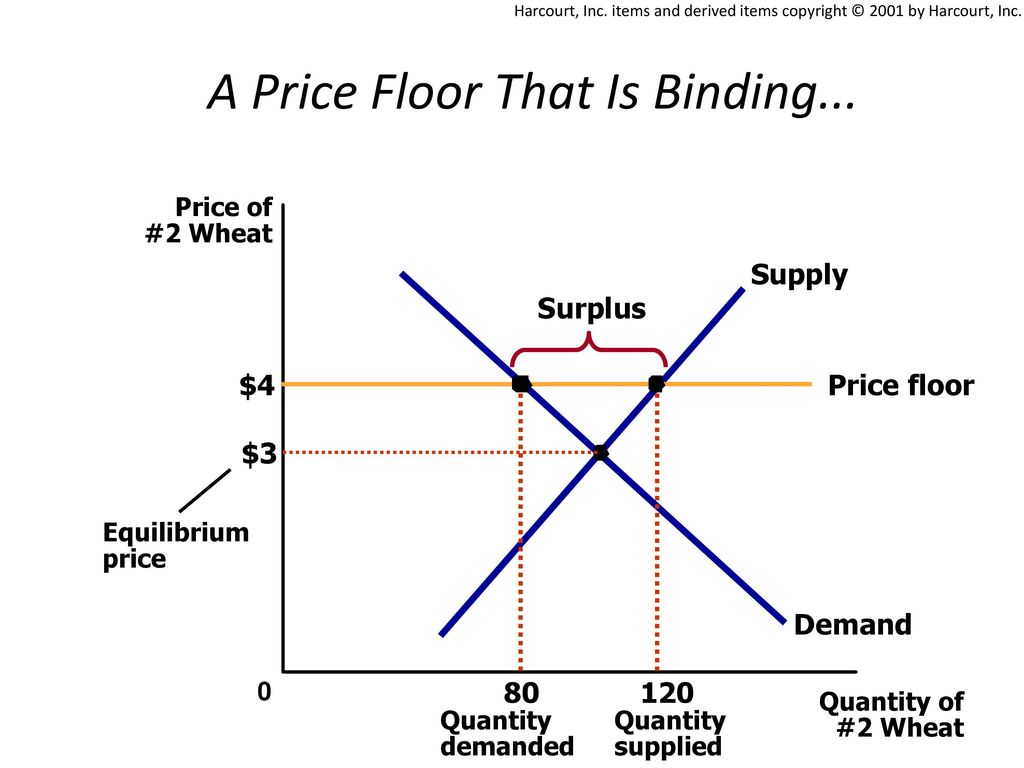

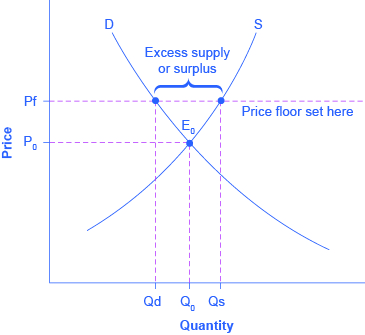

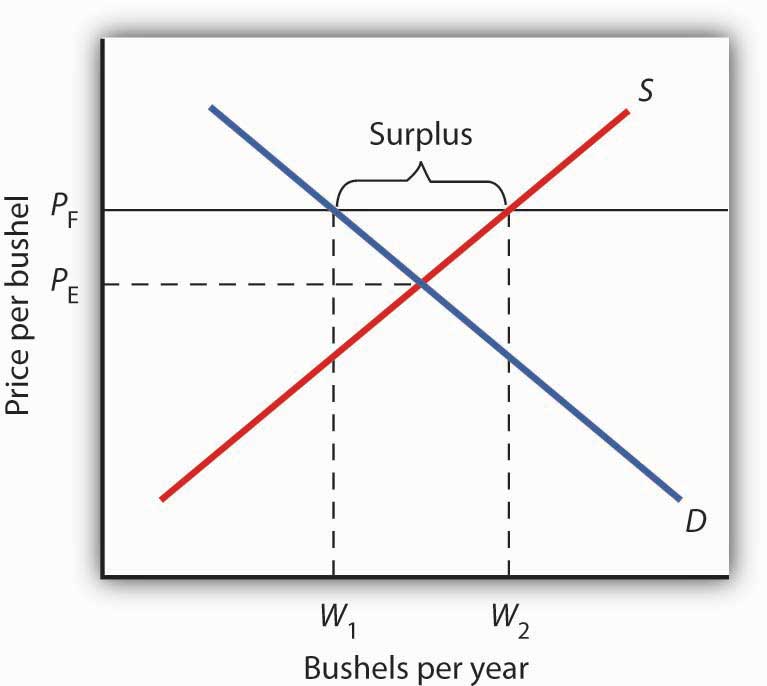

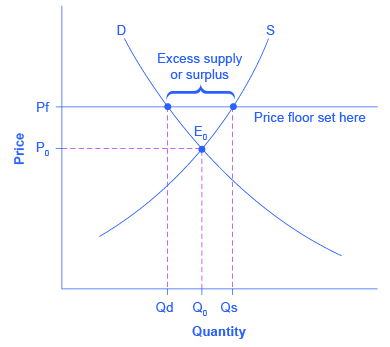

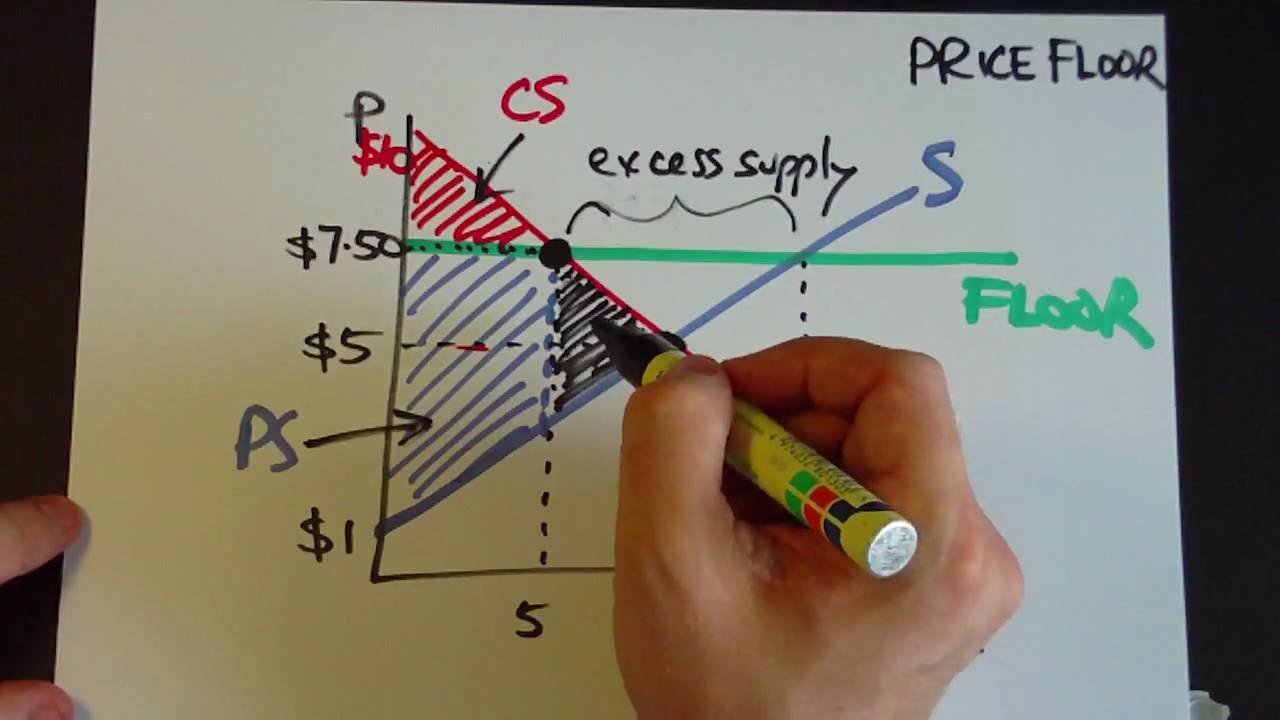

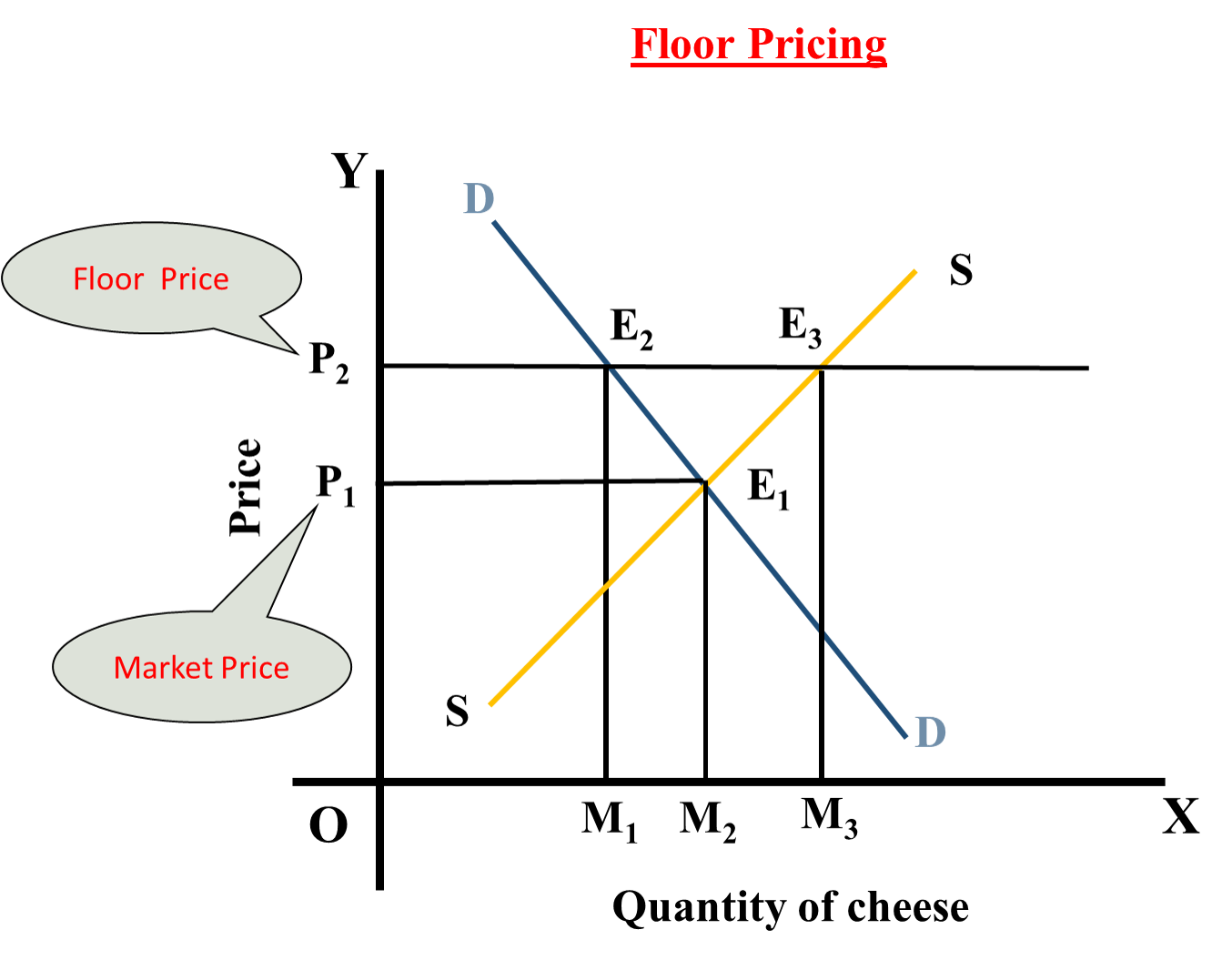

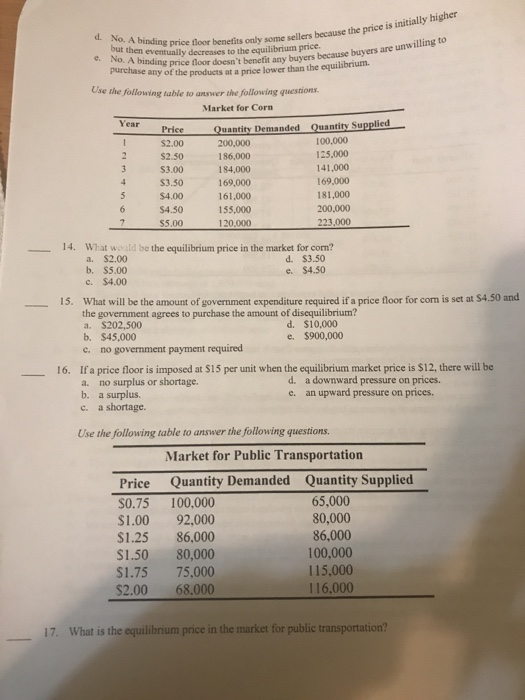

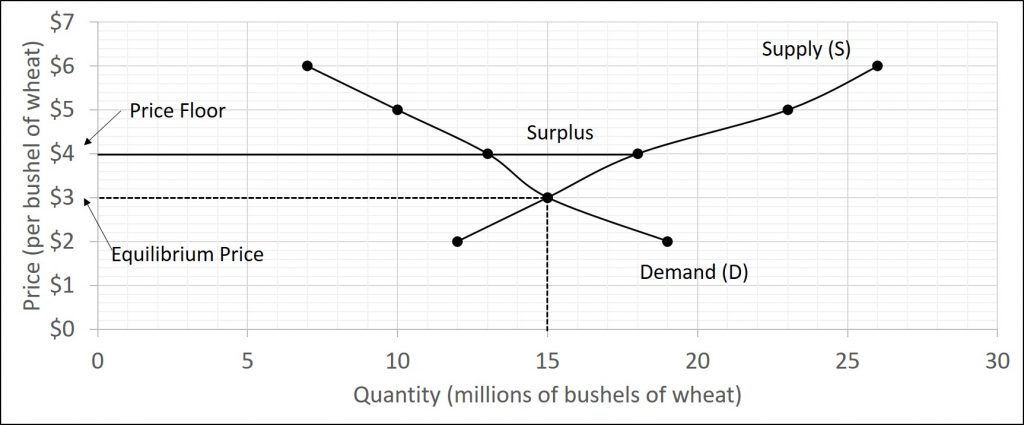

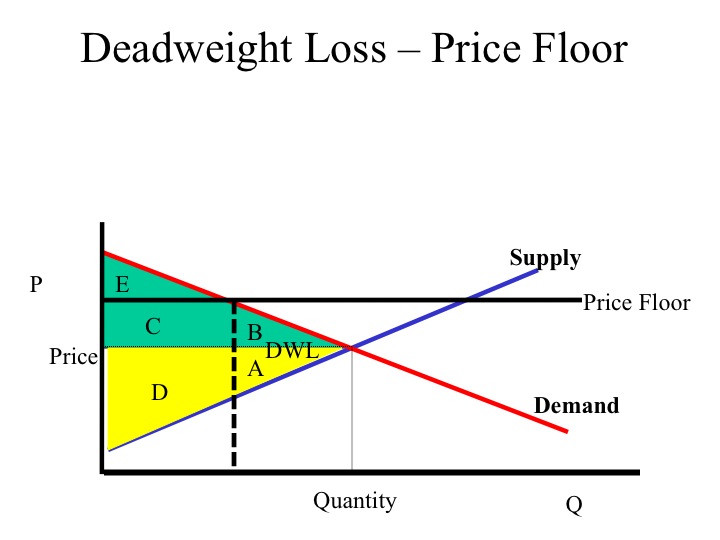

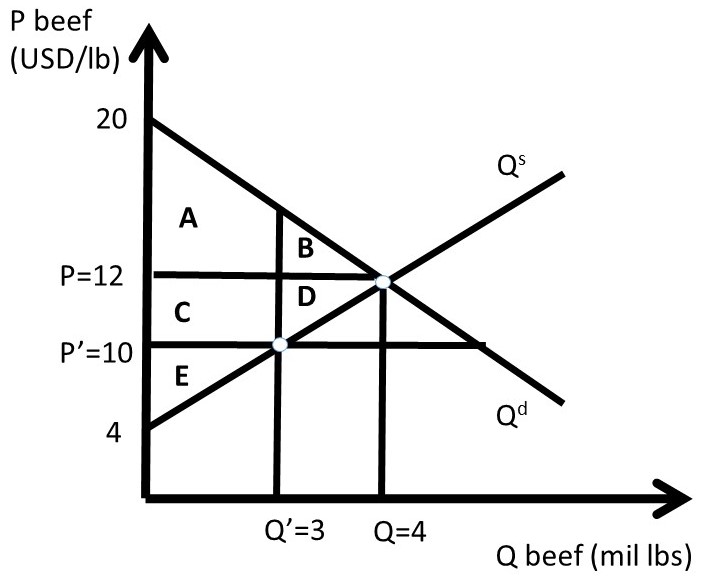

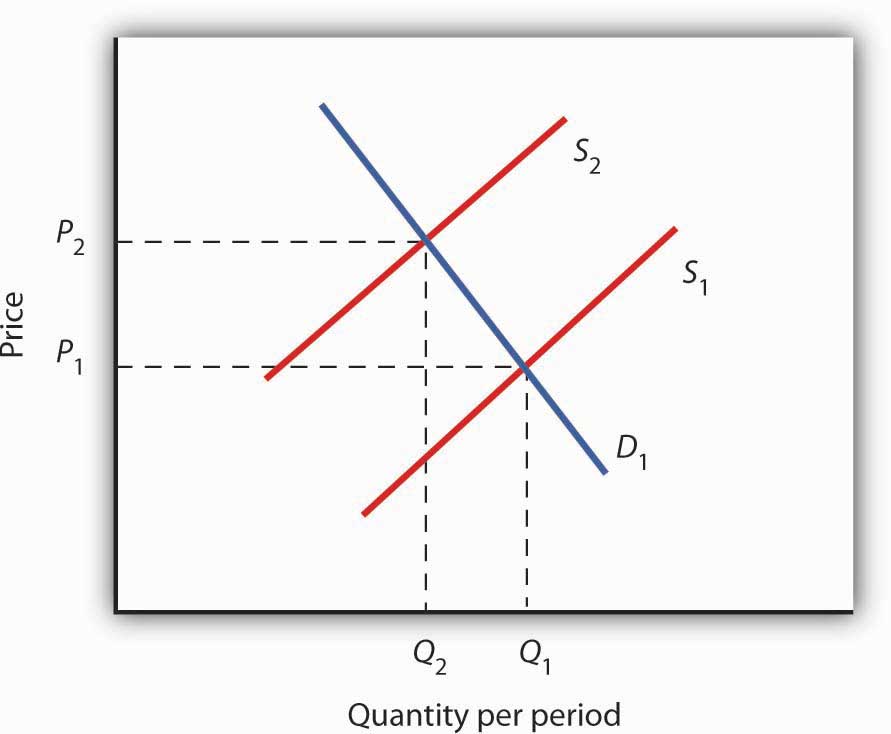

A binding price floor in the market for wheat. There are two types of price floors. Notice that p f is above the equilibrium price of p e. The result of the price floor is that the quantity supplied qs exceeds the quantity demanded qd. A price floor example.

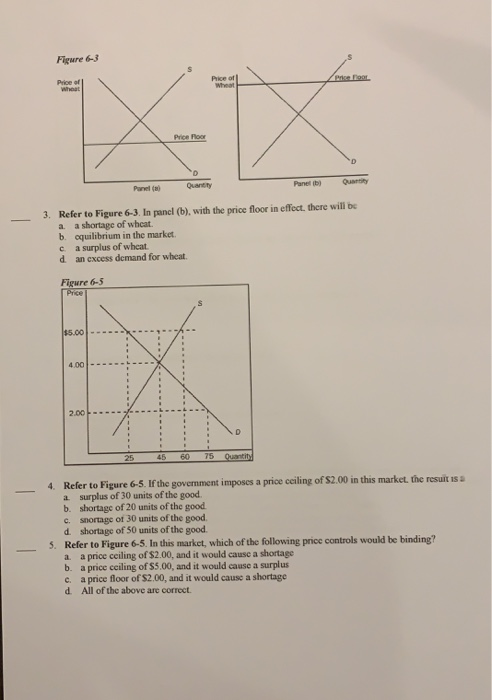

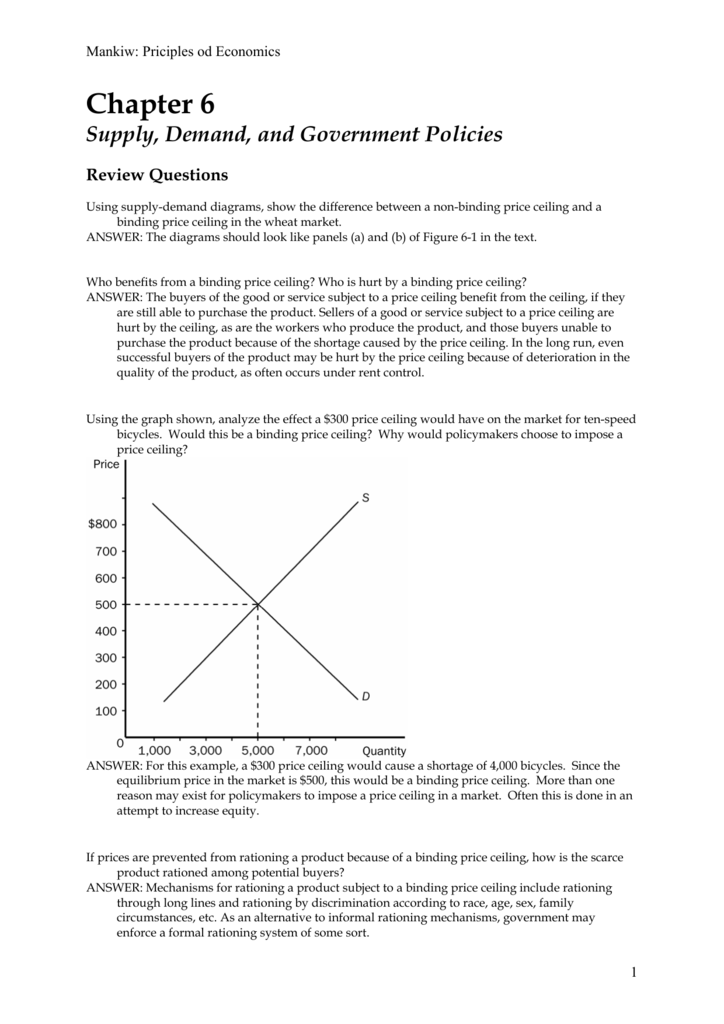

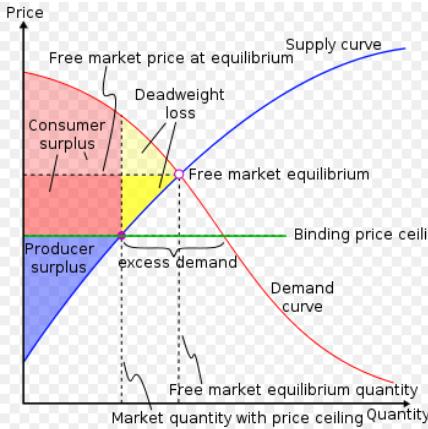

A price floor is the lowest price that one can legally charge for some good or service. Figure 4 8 price floors in wheat markets shows the market for wheat. Consumers are always worse off as a result of a binding price floor because they must pay more for a lower quantity. A price floor is a government or group imposed price control or limit on how low a price can be charged for a product good commodity or service.

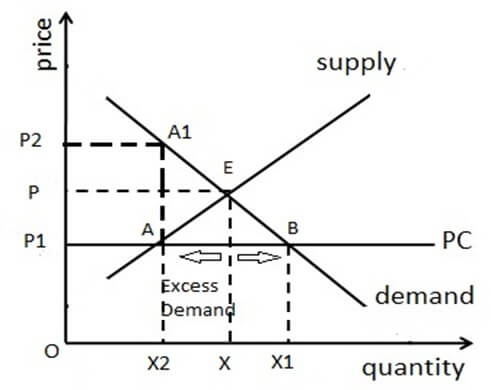

A non binding price floor is one that is lower than the equilibrium market price. Suppose the government sets the price of wheat at p f. A price floor must be higher than the equilibrium price in order to be effective. The result of the price floor is likely to result in.

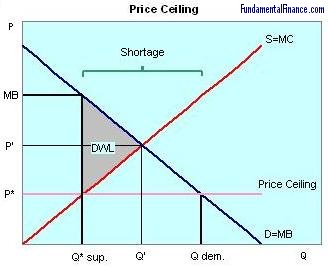

This is a price floor that is less than the current market price. A price floor that is set above the equilibrium price creates a surplus. Consider the figure below. The equilibrium market price is p and the equilibrium market quantity is q.

A price floor or minimum price is a lower limit placed by a government or regulatory authority on the price per unit of a commodity. The equilibrium price commonly called the market price is the price where economic forces such as supply and demand are balanced and in the absence of external. A price floor is a form of price control another form of price control is a price ceiling.